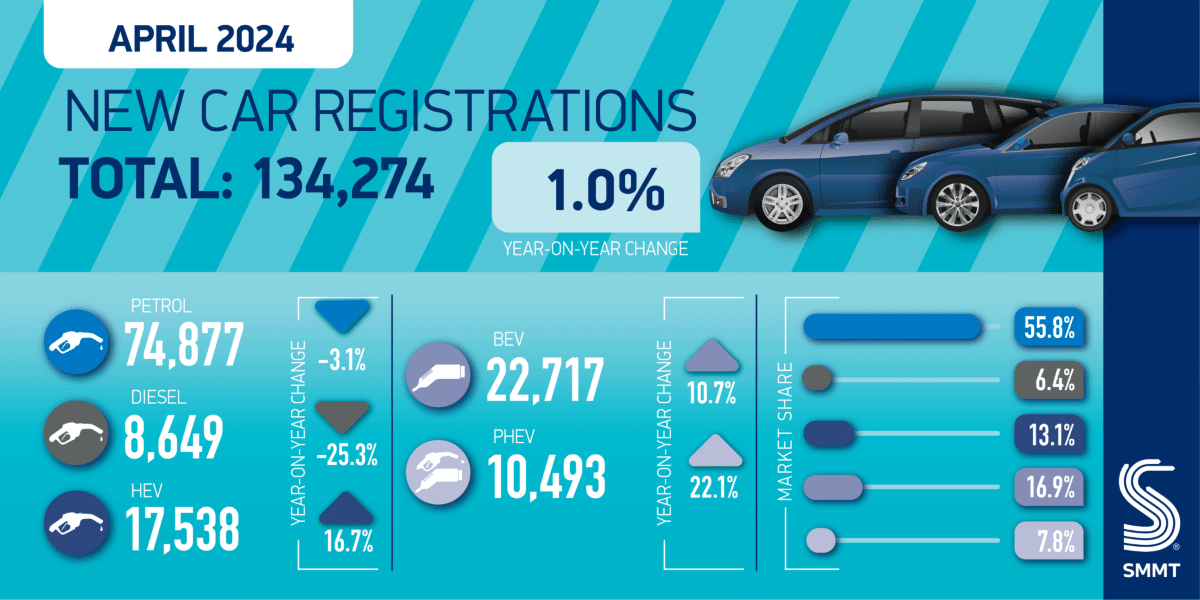

UK new car registrations grew for the 21st consecutive month in April, rising by a modest 1.0% to reach 134,274 units, according to the latest data published by the Society of Motor Manufacturers and Traders (SMMT).

As a result, this was the market’s best April since 2021, although uptake was still 16.6% below the pre-pandemic level in what is traditionally a low volume month following the March plate change.

Continuing the trend seen throughout the year, growth was driven entirely by fleets, where registrations rose by 18.5% to reach 81,207 units – more than six in 10 of all new cars registered in April. Private buyer uptake fell by 7.7% to 50,458 units, while business registrations declined by 16.1%, to 2,609.

Electrified vehicles continued to be the main drivers of market expansion. Plug-in Hybrids (PHEVs) recorded the strongest growth, rising by 22.1% to account for 7.8% of the market, followed by Hybrid Electric Vehicles (HEVs), up 16.7% with a 13.1% share of demand. April was a brighter month for battery electric vehicle (BEV) registrations, predominantly due to compelling fiscal incentives for businesses. Overall, BEV uptake rose 10.7%, pushing up market share to 16.9%, a significant uplift on last April’s 15.4%.

While the overall increase in BEV demand is positive, urgent action is needed to re-enthuse private buyers into switching. Fewer than one in six new BEVs bought in April went to consumers, whose uptake volumes fell by 21.9%. Drivers today enjoy the widest ever choice of BEV models – more than 100 – powered by the latest technology, and manufacturers continue to provide compelling offers to encourage their uptake. However, the lack of government incentives for private motorists remains a barrier that cannot be overcome by industry alone.

Given tax incentives are proven to deliver a rapid shift to BEVs in the fleet market, providing private buyers with a similar level of support would accelerate an overall market shift, fuel economic growth and deliver a sustainable, fair transition. Temporarily halving VAT on new BEV purchases would help more than a quarter of a million drivers to switch from fossil fuel to electric over the next three years. Similarly, altering the threshold for the ‘expensive car’ supplement to Vehicle Excise Duty – due to apply to EVs from April 2025 – would send the message to the market that zero emission vehicles are necessities, not luxuries.

Action is also needed on infrastructure, with nationwide chargepoint installation essential for consumer confidence. While last year saw more chargepoints installed than ever before, there is currently just one standard charger available for every 35 plug-in cars on the road – a negligible improvement on 2022 when the ratio was one for every 36. With current levels of infrastructure insufficient to inspire more consumers to go electric, there is a clear need for measures to accelerate chargepoint rollout.

Such actions are crucial as, based on current conditions, the latest market outlook shows a diminishing share for BEVs despite a growing overall new car market. 1.984 million new cars are now anticipated to be registered in 2024 – a 4.2% rise on last year, and a 0.5% increase on January’s outlook. However, BEV volumes for this year have been revised downwards by 5.2%, with anticipated market share now 19.8%, significantly below the government target of 22% per manufacturer under the Vehicle Emissions Trading Scheme. While the scheme’s flexibilities mean manufacturers can still meet government mandated targets, long term success depends on a growing market built on strong consumer EV demand.

Mike Hawes, SMMT Chief Executive, said: “The new car market continues to grow even in the quieter months, driven primarily by fleet demand. This is particularly true of the electric vehicle sector, where the absence of government incentives for private buyers is having a marked effect. Although attractive deals on EVs are in place, manufacturers cannot fund the mass market transition single-handedly. Temporarily cutting VAT, treating EVs as fiscally mainstream not luxury vehicles, and taking steps to instil consumer confidence in the chargepoint network will drive the market growth on which Britain’s net zero ambition depends.”

Sue Robinson, Chief Executive of the National Franchised Dealers Association, said that whilst the automotive sector has demonstrated its robustness this year and is showcasing signs of returning to pre-pandemic levels, there are still issues which need to be addressed. “Namely, year to date electric vehicle market share remains only 0.3% higher when compared to the same point last year. With the Government disappointingly ruling out introducing price incentives for electric vehicles last month, NFDA calls on the Government to have an urgent rethink, particularly as many OEMs seek to meet ZEV mandate targets for this year and with private demand having declined in recent months.”

She added: “Electric vehicle sales continue to demonstrate moderate growth, but fleet remains the driving force behind new car registrations, with private demand languishing in recent months.”

Kim Royds, Mobility Director at Centrica, said: “EV production levels are at record rates – but driver demand is still lagging behind. To balance supply and demand, more work is needed to help drivers overcome the barriers to making the switch.

“Top of the list must be tackling the inequality between domestic and public charging infrastructure. If more people have access to a chargepoint, whether they have a driveway or not, it stands to reason that EVs will become more attractive to a greater portion of the population.

“Without doubt, continued collaboration and knowledge-sharing between vehicle manufacturers and energy providers is needed to provide charging solutions that are both affordable and accessible.”

James Hosking, Managing Director of AA Cars, added: “The shot in the arm provided by March’s new registration plates continued to boost sales in April — leading to a 21st straight month of growth. With falling inflation slowly easing the pressure on household budgets, consumer confidence is stabilising – and this is leading many people who held off changing cars last year to do so now.

“While demand from drivers is holding up well, separate manufacturing data from the SMMT shows that the number of new vehicles rolling off UK production lines in March was 27% lower than the same month last year.

“This decline has been linked to manufacturers retooling their factories as they prepare to produce next-generation models, including EVs. As the industry makes this transition toward greener transportation options, there may be some temporary adjustments in production schedules.

“But manufacturers remain committed to maintaining a steady output. By proactively addressing potential supply chain challenges and minimising delays, they can continue to meet consumer demand for their latest vehicle offerings.”

Leave A Comment